Film4Climate announces partnership with the Cineteca of Bologna - Film director Fernando Solanas presents “Viaje a Los Pueblos Fumigados”

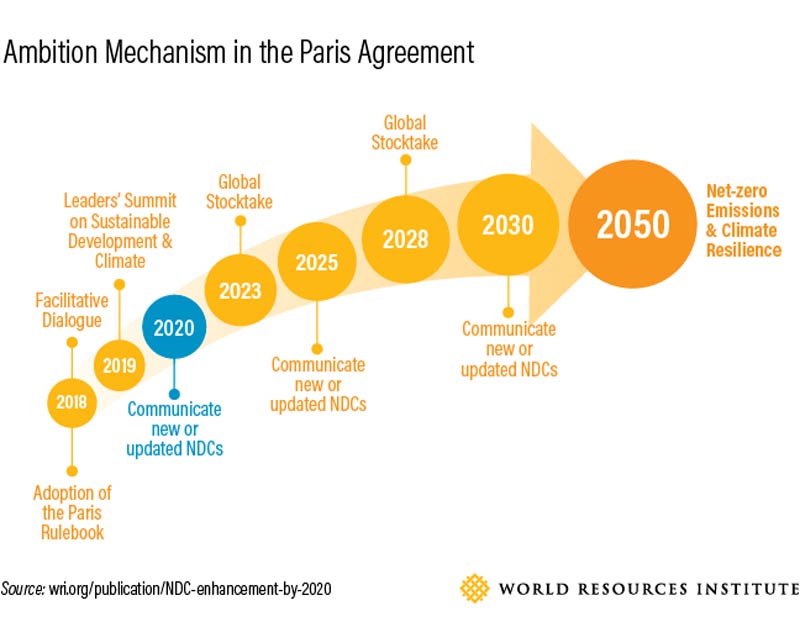

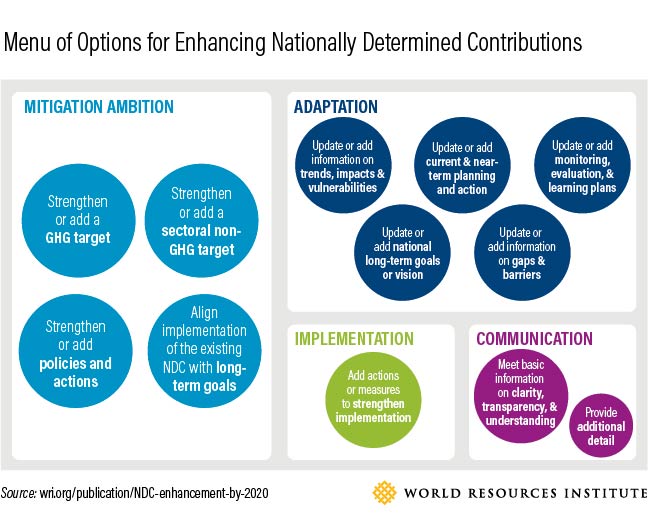

The current NDCs were developed by Parties ahead of Paris, quickly and with no certainty of the final outcome. With the Paris Agreement now in force and with implementation guidelines to be finalized at the end of 2018, Parties can factor in recent innovations and declining costs of renewable energy to take advantage of opportunities in key sectors to send accurate signals to investors. Many countries have long-term plans and strategies related to climate, development, and economic objectives. Taking the opportunity now to align NDCs with these long-term goals and strategies will avoid locking in high emissions that will exacerbate climate vulnerabilities. For example, analysis has revealed the high potential for synergies between achieving the Sustainable Development Goals and the NDCs.

The next years could offer new areas of cost-effective climate action. Lastly, many countries have already made substantial progress and some appear to be on track to exceed the targets in their current NDCs.

[video:https://vimeo.com/256508455]

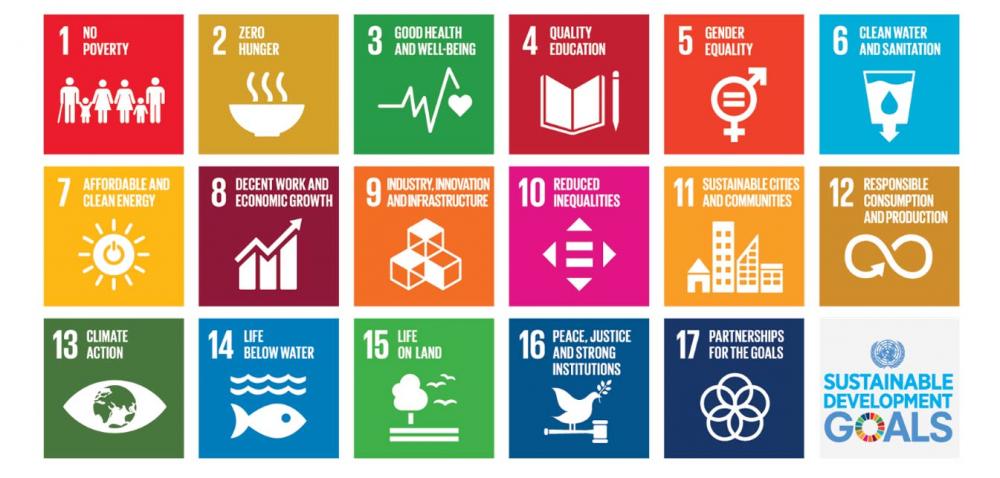

According to a new Global Opportunity Report from DNV GL, Sustainia and the United Nations Global Compact, renewed efforts are required to ensure four of the 17 UN Sustainable Development Goals do not miss their 2030 targets. The Global Goals addressed in the report are Goal 10: Reduced Inequalities, Goal 12: Responsible Consumption and Production, Goal 13: Climate Action and Goal 14: Life Below Water.

Global Opportunity Report 2018 highlights four Sustainable Development Goals (Goal 10, 12, 13 and 14) that are likely to miss their 2030 targets

Global Opportunity Report 2018 highlights four Sustainable Development Goals (Goal 10, 12, 13 and 14) that are likely to miss their 2030 targets

The report contains 10 new business opportunities which help these four goals progress

The report contains 10 new business opportunities which help these four goals progress

The new Global Opportunity Report and the 2015, 2016 and 2017 editions collectively demonstrate market potential in all 17 SDGs — including the ones we are least on track to reach

The new Global Opportunity Report and the 2015, 2016 and 2017 editions collectively demonstrate market potential in all 17 SDGs — including the ones we are least on track to reach

The second edition of “Innovate4Climate Finance and Markets Week” will take place at the Kap Europa Congress Centre in Frankfurt, from May 22 to 24. Innovate4Climate is a new global dialogue of government, multilateral, business, banking and finance leaders focused on shaping the next generation of climate finance and policy instruments.

The first deal is with Energy Efficiency Services Limited, or EESL – a company that finances residential and public sector energy efficiency investments in India. EESL has already deployed more than 275 million LED bulbs, 4.2 million LED tube lights, and 4 million street lights in municipalities throughout India. Through an innovative bulk procurement business model, EESL has driven down prices to make climate-smart LED bulbs as affordable as conventional bulbs, saving energy costs for customers. Early next year, EESL will use a 220 million dollar World Bank (IBRD) loan, combined with an 80 million dollar guarantee facility, and leverage 200 million dollars of commercial finance to deploy thousands of electric cars and charging stations and millions of smart meters throughout India.

The first deal is with Energy Efficiency Services Limited, or EESL – a company that finances residential and public sector energy efficiency investments in India. EESL has already deployed more than 275 million LED bulbs, 4.2 million LED tube lights, and 4 million street lights in municipalities throughout India. Through an innovative bulk procurement business model, EESL has driven down prices to make climate-smart LED bulbs as affordable as conventional bulbs, saving energy costs for customers. Early next year, EESL will use a 220 million dollar World Bank (IBRD) loan, combined with an 80 million dollar guarantee facility, and leverage 200 million dollars of commercial finance to deploy thousands of electric cars and charging stations and millions of smart meters throughout India.

The second deal is on Indonesia Geothermal – a Resource Risk Mitigation Facility, established by the Government of Indonesia with support from the World Bank and other partners. The Facility will provide concessional funding and grants to pool and reduce the exposure of developers in the early exploration and drilling phases of geothermal projects. With a 150 million dollar investment from the Government of Indonesia and 325 million dollars in concessional financing, Indonesia Geothermal is expected to leverage up to four billion dollars in private sector funding to develop more than one gigawatt of new thermal capacity, which is part of Indonesia’s target to add 5.8 gigawatts of geothermal power generation by 2026.

The second deal is on Indonesia Geothermal – a Resource Risk Mitigation Facility, established by the Government of Indonesia with support from the World Bank and other partners. The Facility will provide concessional funding and grants to pool and reduce the exposure of developers in the early exploration and drilling phases of geothermal projects. With a 150 million dollar investment from the Government of Indonesia and 325 million dollars in concessional financing, Indonesia Geothermal is expected to leverage up to four billion dollars in private sector funding to develop more than one gigawatt of new thermal capacity, which is part of Indonesia’s target to add 5.8 gigawatts of geothermal power generation by 2026.

The third deal is with the new City Resilience Program – or CRP, where we’re partnering with the Global Covenant of Mayors to bring together the largest global alliance of cities committed to tackling climate change. CRP will design and structure climate resilient investments and catalyze new sources of capital to finance them. Over the next three years, the CRP will leverage 4.5 billion dollars in World Bank loans to catalyze billions in public and private capital for technical assistance, project co-financing, and credit enhancement. Essentially, the program will act as an investment banker for cities to structure programs that address their vulnerabilities to climate change. The first phase is starting with more than 30 cities, with the goal of scaling to more than 500 cities in the next decade.

The third deal is with the new City Resilience Program – or CRP, where we’re partnering with the Global Covenant of Mayors to bring together the largest global alliance of cities committed to tackling climate change. CRP will design and structure climate resilient investments and catalyze new sources of capital to finance them. Over the next three years, the CRP will leverage 4.5 billion dollars in World Bank loans to catalyze billions in public and private capital for technical assistance, project co-financing, and credit enhancement. Essentially, the program will act as an investment banker for cities to structure programs that address their vulnerabilities to climate change. The first phase is starting with more than 30 cities, with the goal of scaling to more than 500 cities in the next decade.

The fourth deal is the West African Coastal Areas Management Program, or WACA, which targets 17 West African countries with the goal of crowding-in two billion dollars to tackle coastal erosion, flooding, and climate change adaptation. The city of St Louis in Senegal will be one of the first beneficiaries. An initial 215 million dollar package that includes 180 million dollars from our IDA fund for the poorest countries, 20 million dollars from the Global Environment Facility (GEF), and nine million dollars from the Nordic Development Fund (NDF) will be presented to the World Bank Board early next year. Then we expect further public and private investments will be mobilized, including, for example, financing for tourism operations.

The fourth deal is the West African Coastal Areas Management Program, or WACA, which targets 17 West African countries with the goal of crowding-in two billion dollars to tackle coastal erosion, flooding, and climate change adaptation. The city of St Louis in Senegal will be one of the first beneficiaries. An initial 215 million dollar package that includes 180 million dollars from our IDA fund for the poorest countries, 20 million dollars from the Global Environment Facility (GEF), and nine million dollars from the Nordic Development Fund (NDF) will be presented to the World Bank Board early next year. Then we expect further public and private investments will be mobilized, including, for example, financing for tourism operations.

Hosted by the World Bank Group and supported by Italy’s Ministry of the Environment and Energy Security and Germany’s Federal Ministry for Economic Cooperation and Development, Connect4Climate (C4C) is a global partnership for a livable planet that connects, creates, and communicates to build long-lasting change for future generations.